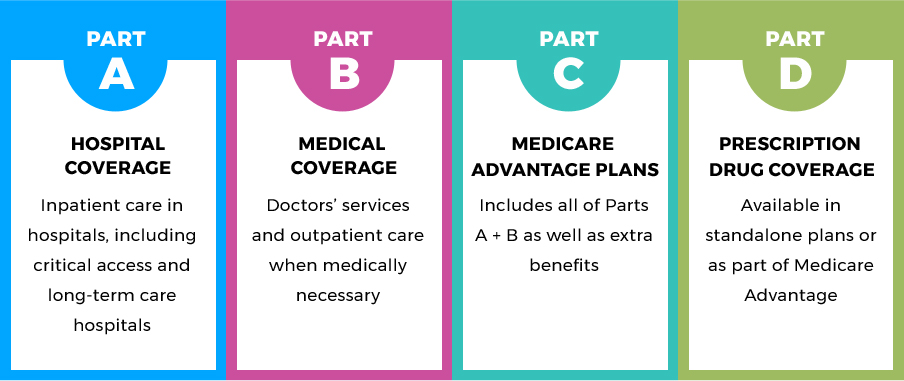

In addition, you may have to pay lifetime penalties for late enrollment in Medicare and your premiums may increase by 10 percent or more.If you don’t sign up for Medicare Part B (medical insurance) during your initial enrollment period, you will have to wait for the general open enrollment period (Jan.1 to March 31), and then your coverage wouldn’t begin until July of that year. Or, there could be a delay in your Medicare coverage start date.You may have to pay back all or some of your premium tax credits to the Internal Revenue Service (IRS).If you are eligible for Medicare and you keep your Covered California plan, you may face serious consequences. You must cancel your plan yourself at least 14 days before you want your coverage to end by contacting Covered California. Your Covered California plan won’t be automatically canceled when you become eligible for Medicare, even if you enroll in a Medicare plan with the same insurance company. People who are eligible for Medicare must report their Medicare eligibility to Covered California within 30 days and will usually need to cancel their Covered California. In general, people who are eligible for Medicare - even if they do not enroll in it - aren’t eligible to receive financial help (premium tax credits) to lower the cost of a Covered California health plan. Make sure you take action and keep track of important dates and deadlines to avoid unwanted consequences. Transitioning from Covered California to Medicare is an important step. Medicare Advantage covers hospital and medical insurance, and usually also covers prescription drugs. Instead of purchasing Original Medicare, some people choose to buy a Medicare Advantage plan, which is Medicare Part C. Medicare Part D, also known as prescription drug coverage, can be added to Original Medicare. Medicare Parts A and B combined is also known as “Original Medicare.” Medicare Part B, also known as medical insurance, covers certain doctors’ services, outpatient care, medical supplies and preventive services. If you don’t qualify for premium-free Part A, you may have the option to pay for hospital insurance, also called “premium Part A”.

#MEDICARE PART ABCD FREE#

Medicare Part A is usually free if you or your spouse paid Medicare payroll taxes for approximately ten years while working (this is called “premium- free Part A”). Medicare Part A, also known as hospital insurance, covers inpatient hospital stays, care in a skilled nursing facility, hospice care and some home health services.

Medicare shouldn’t be thought of as a single program - it’s made up of several parts that provide coverage for different types of services. You can get free counseling regarding your Medicare eligibility and enrollment options, including whether you qualify for programs to reduce your Medicare costs, by calling the Health Insurance Counseling and Advocacy Program (HICAP) at (800) 434-0222. If you are currently a Covered California enrollee and become eligible for or are enrolled in Medicare, you may need to take immediate action to avoid financial penalties and gaps in health coverage. It’s important to note that Covered California doesn’t sell Medicare plans. Medicare is a federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with permanent kidney failure. It’s important to understand how this kind of coverage fits in with coverage through Covered California and the steps you’ll need to take to transition to Medicare on time.

If the doctor or facility is out of network, you will pay a larger portion of your medical bill.When you become eligible for Medicare, there’s a lot to consider. While there are many other features to an HMO, the main thing to know is that they use networks to manage care and costs.Ī PPO (Preferred Provider Organization) gives flexibility regarding the doctors you see and the health care facilities you use. This is because the provider is not in your Medicare HMO plan’s network. If you use an out-of-network provider, you will likely pay all of your medical bills, with the exception of emergency or urgent care visits. You will likely pay a lower rate for care. If you use an in-network doctor or hospital, it means the provider is approved by your plan. By looking at your specific circumstances, we will assist you in choosing the plan that is right for you, based on your individual needs and budget.Īn HMO (Health Maintenance Organization) features a network of approved doctors, hospitals, and other health care facilities. The two most popular are HMO and PPO plans.

0 kommentar(er)

0 kommentar(er)